Introduction

One of my sons is a newly minted accountant. He dreams of someday managing a hedge fund. We spend hours talking about modeling data and making predictions. These discussions have convinced me that I need to know more about financial engineering. To learn more about the subject, I have been watching Youtube videos by the Bionic Turtle. I enjoy these videos because they are informative and short (my attention span is not what it used to be, and it wasn't good even then).

Anyway, the other day I watched a video by the Bionic Turtle on leasing automobiles. Normally, computing lease payments requires using time value of money equations. During the Bionic Turtle lecture, I found that the automobile dealers use an approximation to the time value of money equations that makes their calculations much simpler (i.e. they can be done on a "four banger" calculator). Unfortunately, the video did not go into any detail about the approximation. Since my entire career is a celebration of detail, I could not let this go. 🙂

Kidding aside, I found that deriving the approximation interesting and worth going through here. The derivation involves the creation of a term called the "money factor." Since I do not like "magic numbers" in calculations, I wanted to know where this term comes from.

Note that I do not lease my vehicles. I buy them and drive them into oblivion. My interests here are strictly mathematical. That said, let's dig in ...

Background

Approaches to Lease Modeling

The basic concept of auto leasing is simple:

- You are using a depreciating asset.

- The auto dealer expects you to pay for the depreciation.

- The auto dealer expects to earn a competitive return on his investment.

- At the end of the lease period, you return the auto to the dealer. He can then sell or lease the used vehicle to someone. Of course, you can decide to buy the vehicle at the end of the lease period.

We can look at the problem from three points of view: future value, present value, and money factor approximation. Fortunately, the future value and present value solutions provide us exactly the same answer. The money factor approximation is useful in that it allows a very accurate loan payment approximation to be computed without having to take numbers to powers. I will go through the math for each point of view.

Pricing

Price is a complex thing when it comes to leasing. For the purposes of this post, I will use four forms of price:

- PL is the list price.

Almost no one who buys a car pays list price. Nearly everyone negotiates the price down even a little. I personally have negotiated car prices at "no negotiation" dealers. This is important especially for new car owners who need to ship their cars using a shipping service similar to CarsRelo. The main use of the list price in my analysis here is in determining the value of the car at the end of the leasing period. This is often done as a percentage of the list price. - PN is the negotiated price of the car.

This is the price agreed upon by the lessor and lessee. - PF is the amount of money being financed through the lease.

People who lease cars often have to make a down payment, which reduces the amount of money that is covered by the lease. - R is the residual value of the car at the end of the lease. It is often expressed as a percentage of the list price.

Interest Rates

I express the lease interest rate in two equivalent forms:

- I is the lease's annual percentage interest rate.

- i is the per payment interest rate.

Since most leases assume monthly payments,.

Analysis

In the following analysis, I will be working through a lease example from this web site. I liked their approach and thought it was a good example. My focus is on explaining the use of an approximation in determining the value of the lease payment.

Future Value Viewpoint

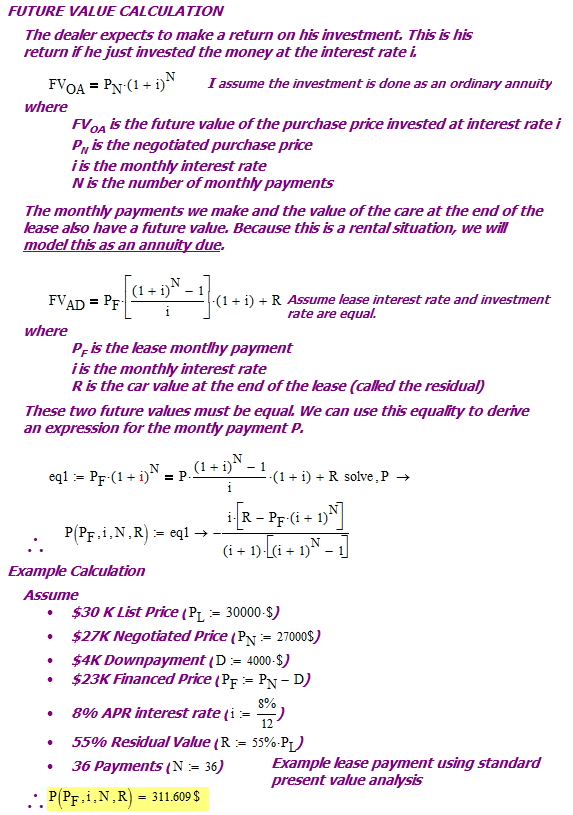

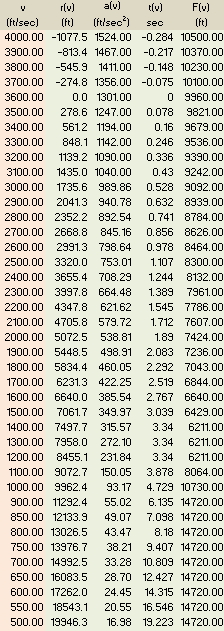

Figure 1 summarizes the derivation of the lease from the future value standpoint. It includes a worked example that shows how to handle the case of making a down payment and negotiating a lower price. As stated earlier, the example is from here. Note that I model the lease payments as an annuity due (information here).

Appendix A shows the same calculation performed using Excel. The results are identical.

Present Value Viewpoint

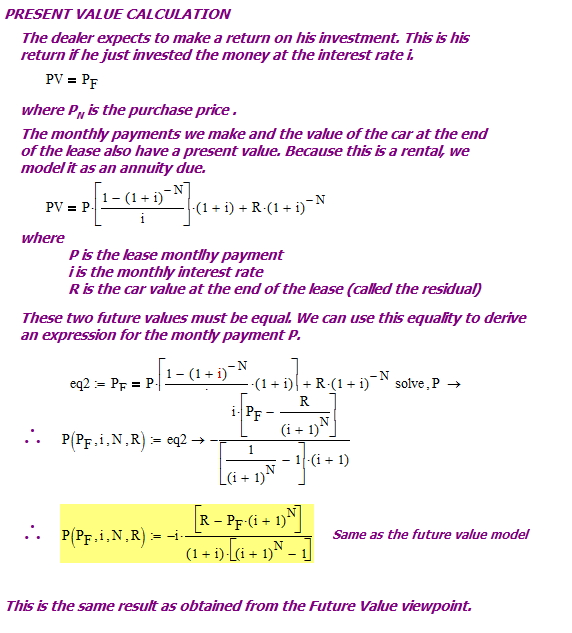

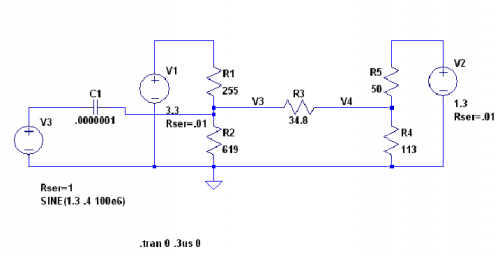

Figure 2 shows how the same lease payment formula can be derived from the present value viewpoint.

Money Factor Viewpoint

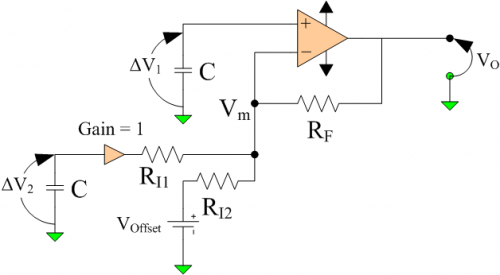

This analysis is interesting to me because of its focus on dealing with averages. Here is a summary of the approach.

- Cars are a depreciating asset. The person leasing the car must pay the depreciation.

- The total interest paid on the lease is equal to the total payments made minus the amount financed (PF).

- The amount of the payment is equal to the average interest paid per payment plus the average depreciation paid per payment.

We can summarize the last bullet with Equation 1.

| Eq. 1 |

where

- P is the monthly lease payment

- PI is the average interest paid per lease payment

- PD is the average amount of depreciation paid off per lease payment

We can calculate the average depreciation paid per payment as shown in Equation 2.

| Eq. 2 |

Determining the average interest paid per payment is a bit more complicated. The keys to determining this relationship are:

- Use of the Taylor series substitution

.

- This means that

.

Equation 3 summarizes the derivation.

| Eq. 3 | ||

| After much painful algebra ... | ||

| Assume that |

||

We can substitute Equations 2 and 3 into Equation 1 to obtain Equation 4, which is the equation the auto dealers use.

| Eq. 4 |

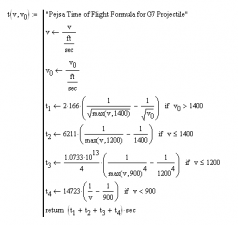

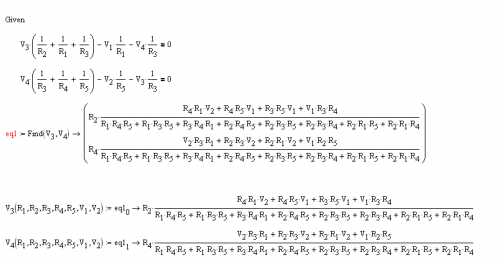

Figure 3 shows that we can work the example of Figure 1 without using powers of numbers and obtain nearly the same answer with much less mathematical effort.

The exact solution gives a payment value of $311.61 and the approximation gives $312.22. This is an error of 0.2%. Not too shabby.

Conclusion

In this post I looked at leasing from a classical viewpoint (present value and future value) and from an approximate viewpoint (money factor). I worked through an example that show that difference between the results is a fraction of a percent. This approximation makes sense for common use because it avoids the human calculator from needing to deal with powers of numbers, which for many folks is an issue.

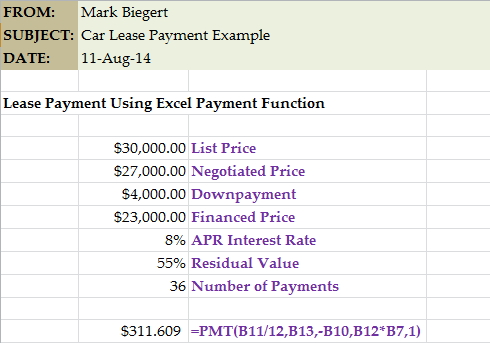

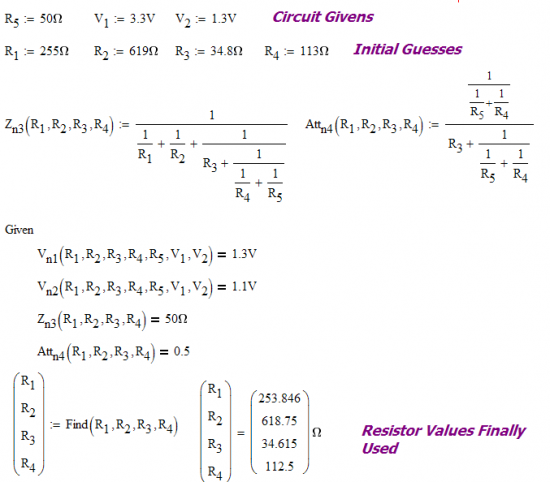

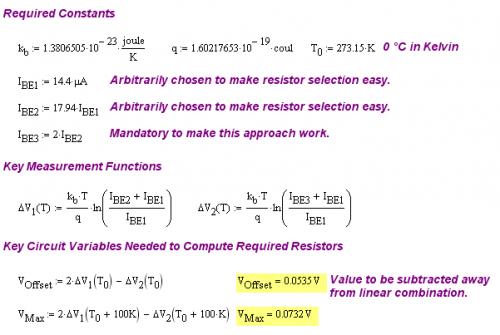

Appendix A: Car Lease Payment Calculation in Excel

Figure 4 show the same calculation done using the Excel PMT function.