In the spring of 1979, I was a soon-to-be-graduated electrical engineer that needed a job. As with other young engineers, I started to look for work during my last semester of school and I got a few nibbles. The most intriguing of the nibbles was from Hewlett-Packard, known by all engineers as "HP." At that time, HP was considered a class engineering act and getting a job there would be perfect for someone with plenty of energy but little experience.

The first interview was on campus and was pretty interesting. HP was known for having a tough on-campus interview. They asked tough questions. The questions weren't necessarily technical – most were puzzles. Fortunately, I like puzzles!

The interview went well and they sent me a plane ticket to Ft. Collins, Colorado for an interview. Soon I was out in Colorado. It was the first time I had flown (excluding one quick flight on a Piper Cub when I was 7). It was also the first time I had stayed at a motel without my parents. It was a trip filled with firsts for the kid from small-town USA!

The interview ended up being a grueling six-hour puzzle-solving session. Once I got over my initial jitters, I relaxed and actually enjoyed the experience. It must have gone well because I received a job offer before I left the building.

During my interview, there was one problem that kept coming up. It turned out the problem had been the subject of much discussion within HP. The Fort Collins facility was filled with engineers who loved math puzzles, which made sense when you think about their interview process. If you hire based on the ability of people to work puzzles, you probably end up hiring people who are good at them.

The problem begins with a young engineer being handed a 1 F (Farad) capacitor that is charged to 10 V.

You are handed a 1 F capacitor charged to 10 V and two boxes containing uncharged capacitors: one box contains an uncharged 1 F capacitor and the other contains 1 million 1 µF capacitors. You can connect the capacitors from one box, one at a time, across the charged capacitor. Your job is to determine which box will allow you to discharge the voltage on the charged capacitor the most?

You are handed a 1 F capacitor charged to 10 V and two boxes containing uncharged capacitors: one box contains an uncharged 1 F capacitor and the other contains 1 million 1 µF capacitors. You can connect the capacitors from one box, one at a time, across the charged capacitor. Your job is to determine which box will allow you to discharge the voltage on the charged capacitor the most?

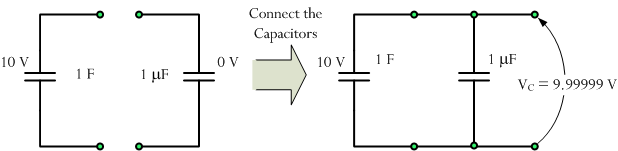

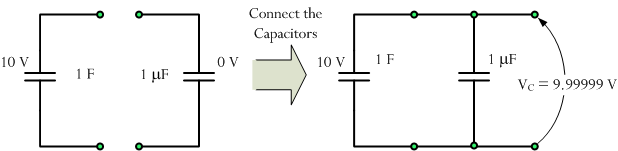

Consider the first box. You can think of a 1 F capacitor as one million 1 µF capacitors in parallel. When this capacitor is connected across the charged capacitor, the final voltage will be 5 V and every capacitor will have the same voltage. The following figure illustrates the situation.

Now consider the box of one million capacitors. The first small capacitor you apply will be charged to nearly 10 V because the capacitor being connected is so small compared to 1 F.

Now consider the box of one million capacitors. The first small capacitor you apply will be charged to nearly 10 V because the capacitor being connected is so small compared to 1 F. We can compute the voltage on the 1 F capacitor using the definition of capacitance. Let

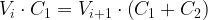

We can compute the voltage on the 1 F capacitor using the definition of capacitance. Let  . We can write the following equations.

. We can write the following equations.

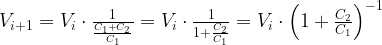

This equation can now be applied one million times to determine the final voltage. Of course, applying this equation one million times means that we will be close to the limit of the following equation. So let's go find the limit.

To simplify my notation, let  . We can then write

. We can then write

When I looked at this equation, I realized that this was the equation for continuous compound interest. While in school, I had seen this limit and I was able to write down the answer directly.

So the answer to the question of whether to choose box one or two was clear ─ choose box 2 with one million 1 µF capacitors. The capacitors will end up charged as shown below.

My interviewer looked stunned. He asked how I knew this and I told him that I had seen the limit before. He looked dismayed and said that he would prefer to see a method that did not require a "miracle" of observation. Our interview time was then over and I had another interviewer to face. Later that day I would receive a job offer and would return to live in Ft. Collins a few months later.

My interviewer looked stunned. He asked how I knew this and I told him that I had seen the limit before. He looked dismayed and said that he would prefer to see a method that did not require a "miracle" of observation. Our interview time was then over and I had another interviewer to face. Later that day I would receive a job offer and would return to live in Ft. Collins a few months later.

When I arrived in Ft. Collins to start my job, one of my interviewers came up to me and asked if I could come up with a more satisfying solution (i.e. one that did not require identifying the series by inspection).

As I looked at the equation, I told my interviewer that l'Hôpital's rule could probably be applied. My interviewer said that l'Hôpital's rule did not apply to equations of this form. Fortunately, I had recently seen a professor solve a similar problem by applying l'Hôpital's rule's to the logarithm of this equation. It turned out that l'Hôpital's rule could be applied to the logarithm of this equation.

The interviewer looked at me with both happiness and dismay. He said that he had been working for months off and on trying to analytically come up with the limit. He also mentioned that my puzzle-solving ability was what motivated them to hire me.

Ever since then, I have fondly thought of this math puzzle. It is hard to believe that it got me my first real job!